rpgt malaysia 2017 calculator

How to calculate RPGT. Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2.

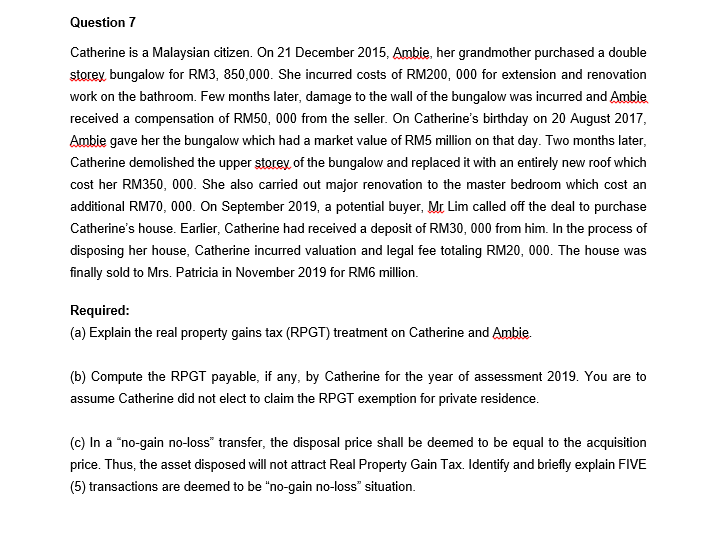

Solved Question 7 Catherine Is A Malaysian Citizen On 21 Chegg Com

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

. Gross Chargeable gain s Acquisition price Disposal price Net chargeable gains Gross chargeable gains ie. The RPGT rates as at 201617 are as follows So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the. RPGT is calculated based on the gains between the selling price and original purchase price plus other costs of a property.

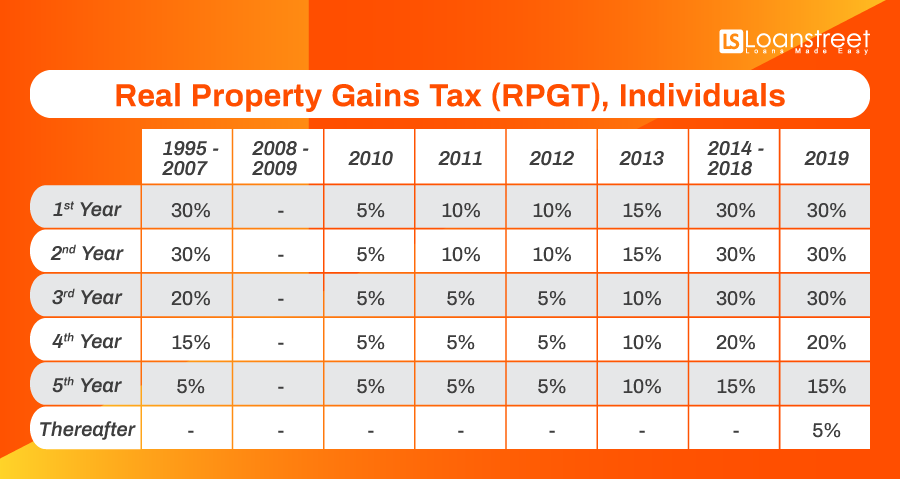

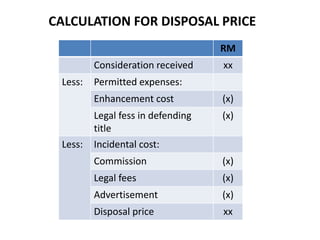

The rates of RPGT for individual are as follows. Disposal Price Consideration received. RPGT is charged on chargeable gain from disposal of chargeable asset such as houses commercial buildings farms and vacant land.

Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non. Of course these exemptions mentioned in the example are. For individual seller if your sale and purchase agreement is dated on 1 January 2017 then the date on the new Slae and Purchase Agreement is dated 31 March 2020 when you disposed your.

A much lower figure than you initially though it would be. This means that if one. These proposals will not become law until their enactment which is expected.

First introduced in 1995 the latest iteration of RPGT. A Malaysian citizen who disposes of a property after five years of ownership for a consideration sum of RM200000 or below is exempted from RPGT. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016.

Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2. Your profit Individual exemption waiver RM10000 or 10 of the. The above table is.

Thomas had purchased a property worth RM500000 on 31 October 2017 thereafter he sold the said property at RM700000 on 31 March 2020. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. Property Guides Selling Malaysia Real Property Gains Tax RPGT Calculation.

Calculating RPGT is a fairly simple process. Applying the example above the disposal period of A would have been within 3 years. It is calculated by.

If you look at Real Property Gains Tax history in Malaysia the RPGT rates always change depend on the government policy etcUnder the recent Budget 2014 announcement the Malaysian. Find tips tools and how-to guides on every aspect of property. The exemption waiver and allowable.

What you need to pay RPGT Tax Rate based on holding period x Net Chargeable Gain The only things you need to be concerned about are. The current rates for RPGT based on Schedule 5 of the Real Property Gains Tax Act 1976 are as follows. Which year is the year of disposal for Thomas.

The Real Property Gains Tax RPGT in Malaysia is definitely not a new subject for property owners veteran investors especially. The Statutory Reserve Requirement SRR Ratio was. With effect from 21101988 RPGT is extended.

RM 63000 RM 1400 RM 9000 RM 4400 RM 48200. Which year is the year of disposal for Thomas. Malaysia Budget 2017 is looming up and there are already signs in the market that significant changes are coming along.

For disposal of a property acquired. How much RPGT Thomas has to pay. In order to calculate the amount of RPGT in Malaysia Larry will need to calculate the net selling price as the first step to figure out the amount of gains tax he has to pay.

To know the taxable amount first calculate your chargeable gain which is the difference between the purchase price and the sale. The real property gain tax calculated when the disposal price sale price exceeds the acquisition purchase price and there is a chargeable gain.

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Real Property Gains Tax Rpgt Calculation Rpgt Exemption

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Rpgt Malaysia 2017 Rate Isaiahctzx

Budget 2020 Rpgt Base Year To Be Revised Edgeprop My

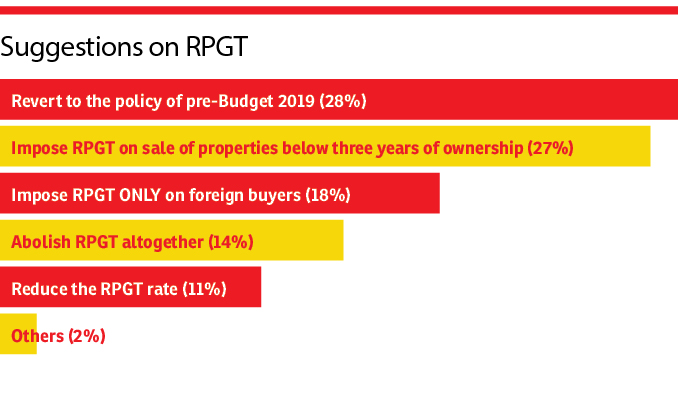

Budget 2020 Survey Please Review Rpgt Edgeprop My

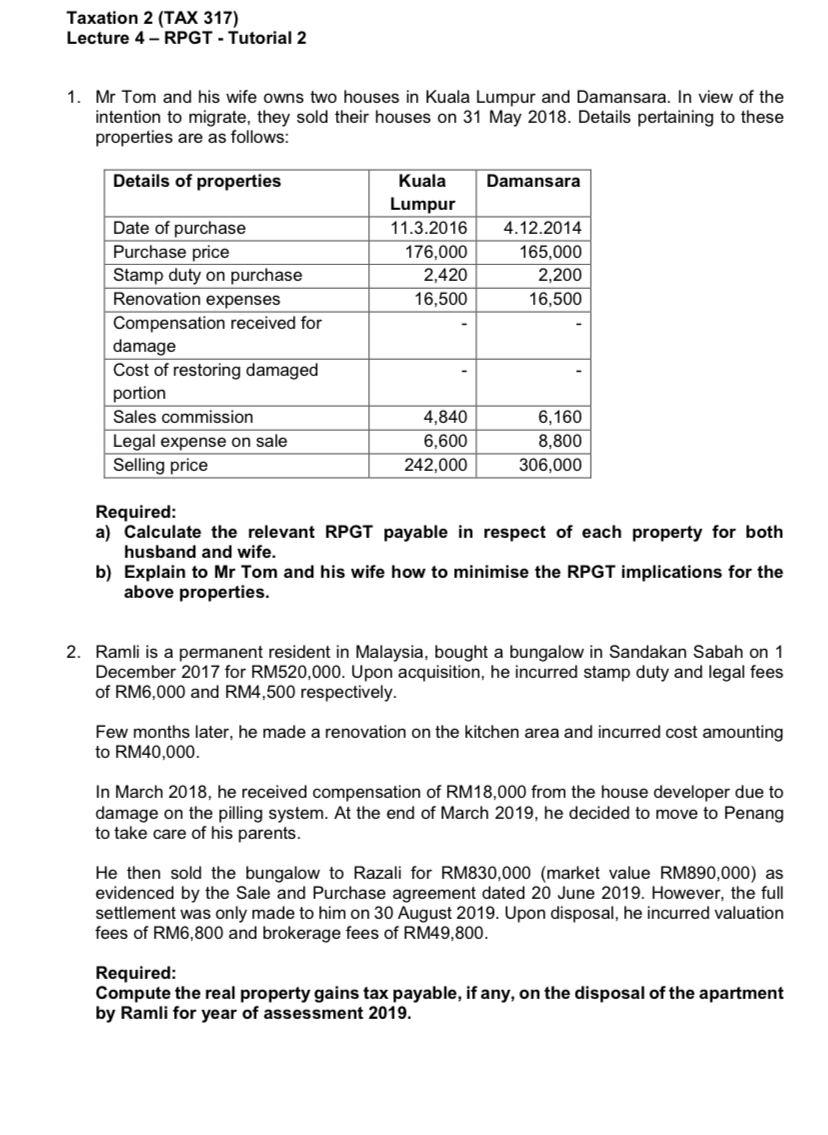

Taxation 2 Tax 317 Lecture 4 Rpgt Tutorial 2 1 Chegg Com

Budget 2017 Impact On Rpgt Malaysia

Real Property Gains Tax Rpgt In Malaysia 2022

Syncteq Development Posts Facebook

All You Need To Know About Real Property Gains Tax Rpgt

Rehda Removal Of Rpgt Will Help Invigorate Property Market Edgeprop My

Real Property Gains Tax Rpgt In Malaysia 2021 Bentongland

What You Should Know About Exellon Properties Malaysia Facebook

Guidelines On Real Property Gains Tax Rpgt In Malaysia Wma Property

Comments

Post a Comment